When you hear the phrase coverage Answer, you may think of anything dull and sophisticated. But let’s be genuine—nobody will get enthusiastic about insurance policy. Until eventually, naturally, they want it. Then it gets to be the superhero of the funds. That’s accurately why we must look at insurance policies solutions in a way that actually is smart. So, let us split it down alongside one another and figure out how these minor protection nets can make your lifetime a lot significantly less nerve-racking.

Picture driving down a highway without any seatbelt, no airbags, and no system if factors go Incorrect. Seems reckless, correct? Nicely, dwelling without having an insurance plan Option is form of like that. It’s risky business enterprise. You would possibly hardly ever crash, but when you are doing, you’re likely to would like you had some kind of cushion to soften the blow. No matter if it’s health, car, house, or life coverage, getting the proper coverage in place is like aquiring a fiscal seatbelt.

So, how Are you aware what the best insurance coverage Resolution appears like in your case? That’s the tough part. There are plenty of varieties and vendors to choose from, it could sense like navigating a maze blindfolded. The excellent news is, as you determine what to look for, getting the right match gets way less complicated. It all commences with knowledge your requirements and asking the best inquiries—like Anything you’re attempting to shield, simply how much possibility it is possible to deal with, and Everything you’re willing to pay.

Allow’s say you’re a freelancer working from home. Your health is your greatest asset. A sound insurance plan Remedy listed here could signify great health and fitness protection, revenue safety, and perhaps even some legal responsibility insurance policies if shoppers go to your property Business. Then again, a youthful family members may be focused far more on lifetime insurance and residential protection to maintain their family and friends Protected regardless of the takes place. Distinctive lives, unique remedies.

Have you at any time tried examining the fantastic print on an insurance policies policy? It appears like decoding historic scripts. That’s why it’s so vital that you opt for a supplier that speaks your language—basically and figuratively. The ideal insurance Alternative isn’t just about the lowest Value. It’s about transparency, trust, and staying there when it counts. You want an organization that describes items in simple English and doesn’t ghost you when it’s time to make a declare.

Have you at any time tried examining the fantastic print on an insurance policies policy? It appears like decoding historic scripts. That’s why it’s so vital that you opt for a supplier that speaks your language—basically and figuratively. The ideal insurance Alternative isn’t just about the lowest Value. It’s about transparency, trust, and staying there when it counts. You want an organization that describes items in simple English and doesn’t ghost you when it’s time to make a declare.The 5-Second Trick For Insurance Solution

Listed here’s a bit magic formula: not all insurance plan is produced equal. Some policies are like Swiss Military knives—filled with attributes. Many others are more like a rusty screwdriver—hardly practical when issues go south. That’s why comparison shopping is your ally. Dig into People evaluations, use on-line applications, and don’t be afraid to pick up the mobile phone and check with the difficult queries. You’re the a person in the driving force’s seat in this article.

Listed here’s a bit magic formula: not all insurance plan is produced equal. Some policies are like Swiss Military knives—filled with attributes. Many others are more like a rusty screwdriver—hardly practical when issues go south. That’s why comparison shopping is your ally. Dig into People evaluations, use on-line applications, and don’t be afraid to pick up the mobile phone and check with the difficult queries. You’re the a person in the driving force’s seat in this article.At any time recognize how we insure our phones, autos, and in many cases our pets—but from time to time ignore ourselves? It’s wild, isn’t it? A effectively-rounded insurance Answer should really constantly get started with you. Your health, your income, your comfort. When that’s locked down, you can begin layering in protection in your things as well as people you treatment about. Consider it like building a safety pyramid with you at the very best.

Now, let’s mention Charge. Coverage premiums can experience like A further every month bill you don’t need. But visualize them like a membership to peace of mind. Absolutely sure, you hope you never utilize it—but when daily life throws a curveball, you’ll be glad it’s there. And below’s a tip: bundling insurance policies, strengthening your credit rating rating, as well as just searching about every year can lower your fees a lot more than you think.

In the event you’re continue to emotion overwhelmed, you’re not by itself. That’s where insurance coverage brokers are available in. These folks are like your personal shoppers for policies. They give you the results you want—not the insurance coverage businesses—and aid match you using an insurance Answer that truly suits your daily life. Just be sure they’re accredited and have excellent evaluations. A terrific broker can help you save time, dollars, and a whole great deal of head aches.

How about electronic insurance policy suppliers? They’re altering the game. You will get prices, file claims, and manage your coverage all out of your telephone. It’s insurance for that Netflix technology. But much like anything else on line, you should definitely study the evaluations and do your homework. Quickly doesn’t constantly suggest better—however it can signify far more handy when performed appropriate.

Facts About Insurance Solution Revealed

Right here’s a wild plan—what if coverage could truly be fun? Ok, perhaps not pleasurable similar to a rollercoaster, but unquestionably gratifying. Realizing you’ve got a reliable insurance policy Answer is like ticking off a major adulting box. It’s one less issue to tension about. You Learn more could snooze much better, get a lot more challenges in your business or travels, and Reside somewhat louder, knowing you’ve received a backup prepare in position.Assume insurance coverage is just for more mature people today or people with families? Nope. Even if you’re young and solitary, owning the best insurance policies Option can be quite a activity-changer. Incidents don’t discriminate. And setting up early normally suggests locking in lessen rates. Additionally, you’ll already be forward in the curve when lifetime receives more complex.

Don’t slide into the entice of considering “it won’t materialize to me.” That’s a dangerous mentality. Fires, floods, ailment, theft—these things don’t send out calendar invites. Remaining geared up isn’t pessimistic; it’s intelligent. It’s like bringing an umbrella. You won't need to have it now, but if the sky turns dim, you’ll be glad it’s in the bag.

At any time hear horror stories about promises being denied? That’s the things of insurance plan nightmares. But below’s the point—nearly all of those tales occur mainly because men and women didn’t go through the policy or selected cheap options with lots of exclusions. A high quality insurance coverage Resolution is evident about what’s lined and what’s not. It’s improved to pay for a tad much more for satisfaction than save a few bucks and risk a monetary catastrophe.

Insurance coverage isn’t 1-size-matches-all. It’s much more just like a tailor-designed suit. Confident, you will find templates, but your needs are one of a kind. A young entrepreneur has unique hazards than the usual retired couple. A homeowner has unique issues than the usual renter. That’s why your insurance policy solution ought to be customized. Cookie-cutter insurance policies just don’t Slash it.

The Best Strategy To Use For Insurance Solution

Unknown Facts About Insurance Solution

Let’s bust another fantasy—acquiring insurance coverage doesn’t indicate you’re shielded from everything. There are constantly limitations and exclusions. It’s like donning armor; it addresses the majority of you, but not every single inch. That’s why you'll want to browse the details, talk to thoughts, and comprehend Anything you’re moving into. The greater you recognize, the fewer surprises down the road.

Everyday living changes quick. Acquired married? Purchased a dwelling? Had a kid? Changed Work opportunities? Every one of these everyday living moments can influence your coverage requires. What labored past year may not operate now. That’s why it’s good to overview your insurance Alternative every year. It’s like a checkup for your finances. Be sure your coverage grows along with you.

Insurance Solution Things To Know Before You Buy

Enable’s not ignore the psychological facet of coverage. When a thing goes wrong, you’re not merely coping with monetary losses. There’s stress, confusion, at times even grief. A terrific insurance provider understands that. They’re not only handing out checks—they’re presenting assistance, guidance, and at times even a shoulder to lean on. That’s the real worth of a considerate insurance plan solution.

You understand what else is cool? Some coverage procedures truly reward you for staying healthier or staying away from mishaps. Feel cashback, lower premiums, or simply reward cards. It’s like getting a pat to the again for doing the correct issue. Who states coverage can’t be a little motivating also?

At the end of the day, finding the correct insurance Option is about guarding your long term. It’s about making certain just one bad working day doesn’t undo several years of hard work. It’s not just paperwork—it’s a promise. A safety Internet. A lifeline. So don’t wait around until it’s far too late. Start off these days. Request inquiries. Look at choices. Check with experts. Your future self will thank you.

So listed here’s the offer—insurance policies may not be flashy, but it surely’s considered one of the smartest moves you can make. It’s similar to the tranquil Buddy who always demonstrates up when things go Completely wrong. With the proper insurance policy Option, you’re not just masking your bases—you’re buying your self peace of mind. And Actually, what’s that worthy of to you personally?

Danny Tamberelli Then & Now!

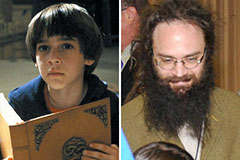

Danny Tamberelli Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!